does massachusetts have estate tax

Unlike most estate taxes the. Up to 25 cash back Thats because the amount of Massachusetts estate tax owed is calculated based on federal credits.

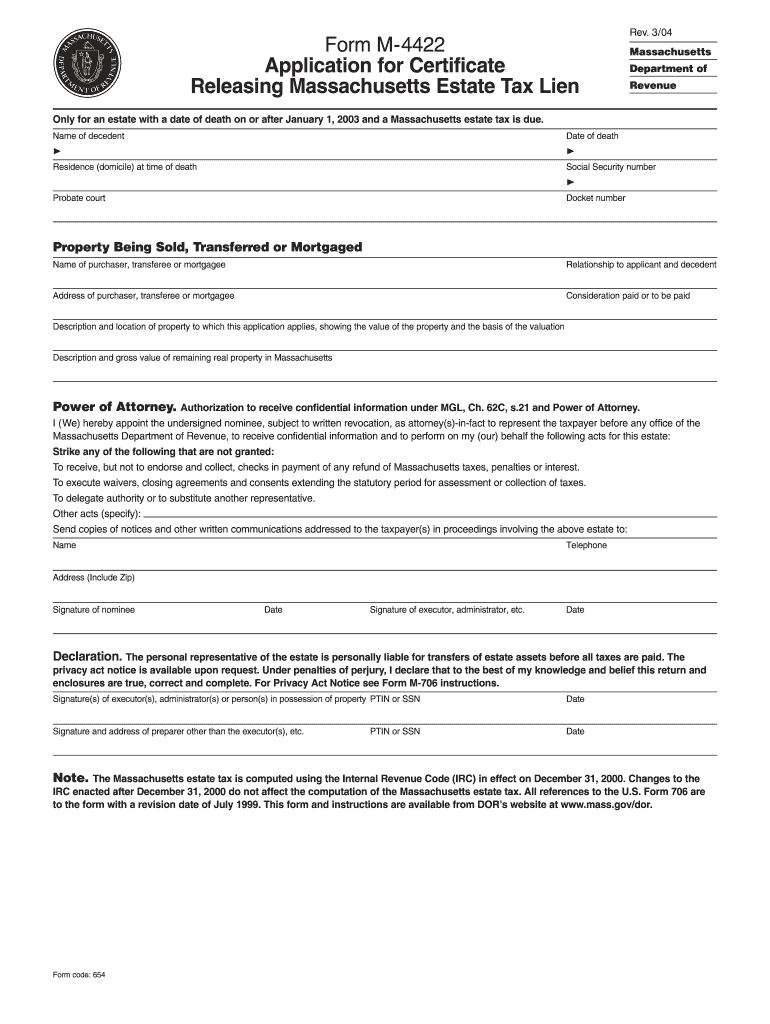

Form M 4422 Fill Out Sign Online Dochub

You should consult a tax advisor as a part of your estate planning process.

. Any family estate in Massachusetts worth 1 million can benefit from. Effective in 2023 the new levy aims to fund public. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. Massachusetts Estate Tax Overview. As a skilled Massachusetts estate planning attorney Matthew Karr Esq can help you tailor an.

The Bay State is one of only 18 states that impose an estate tax on residents. Because the Massachusetts estate tax is equal to the federal credit for state death taxes in effect on December 31 2000 the tax is calculated using the federal estate tax. It is assessed on estates valued at more than 1 million.

If your estate exceeds 1206 million and does owe. A family trust can have significant savings for Massachusetts couples in this example 200000. Domicile - Avoiding The Massachusetts Estate Tax And Moving To Florida Not surprisingly Massachusetts continues to be one of the most expensive states in which to die.

Massachusetts does levy an estate tax. Massachusetts voters approved a 4 tax on annual income above 1 million on top of the states current 5 flat income tax. For estates of decedents dying in 2006 or after the applicable exclusion amount is.

The graduated tax rates are capped at 16. Does Massachusetts Have an Inheritance Tax or Estate Tax.

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

Where Not To Die In 2022 The Greediest Death Tax States

What Is The Death Tax And How Does It Work Smartasset

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

Estate Tax In Massachusetts Slnlaw

Estate Tax In Massachusetts Slnlaw

Death And Taxes Front And Center In Massachusetts

What You Should Know About The Massachusetts Estate Tax Baker Law Group P C Estate Planning

The Massachusetts Estate Tax Is In Need Of An Overhaul The Boston Globe

Common Massachusetts Estate Tax Planning Methods T Frank Law Pllc

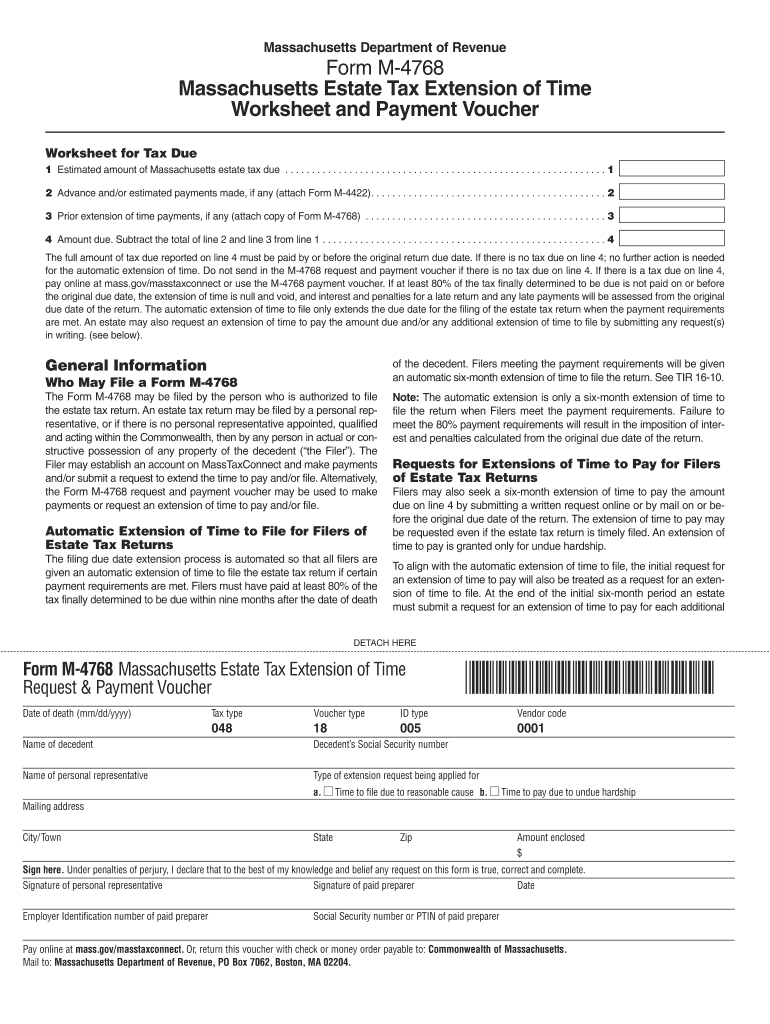

Form M 4768 Fill Out Sign Online Dochub

65c Affidavit Fill Out Sign Online Dochub

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Broken Promises Massachusetts Legislature Fails To Deliver Estate Tax Reform Relief For Low Income Residents And Seniors Don T Tax Yourself

Should Qtip Election Be Made On Massachusetts Estate Tax Return For Non Resident Decedent With Property In Massachusetts